25+ How much ltv can i borrow

As a portion of the value of the property see below for a definition of this term. The piggyback second mortgage can also be financed through an 8020 loan structure.

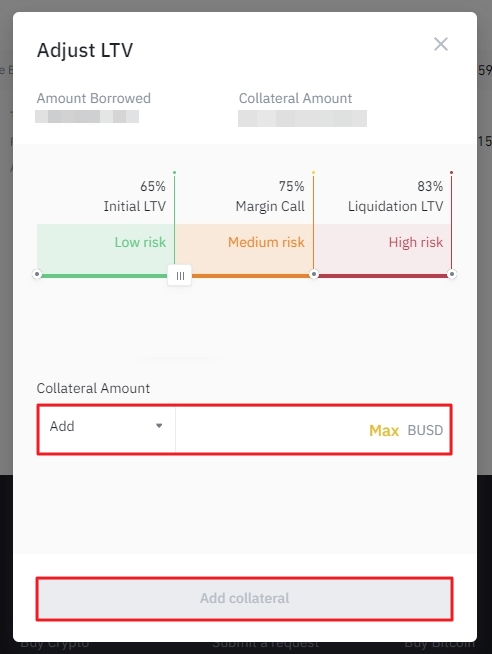

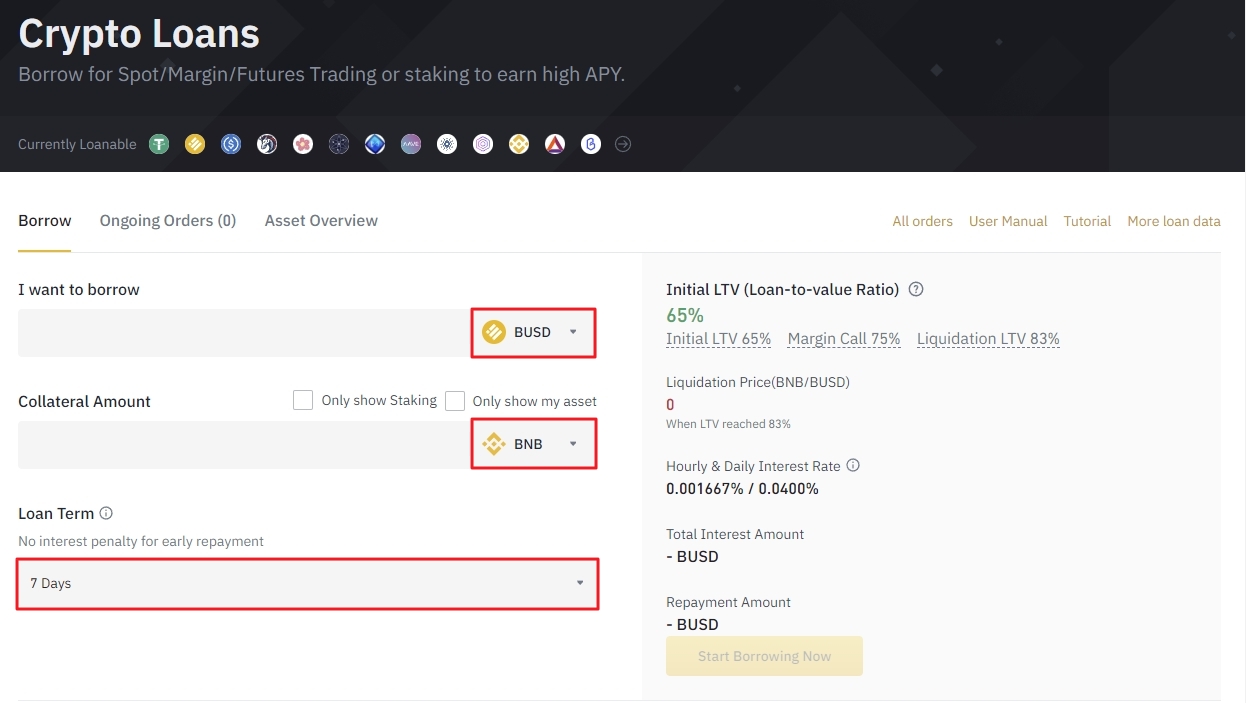

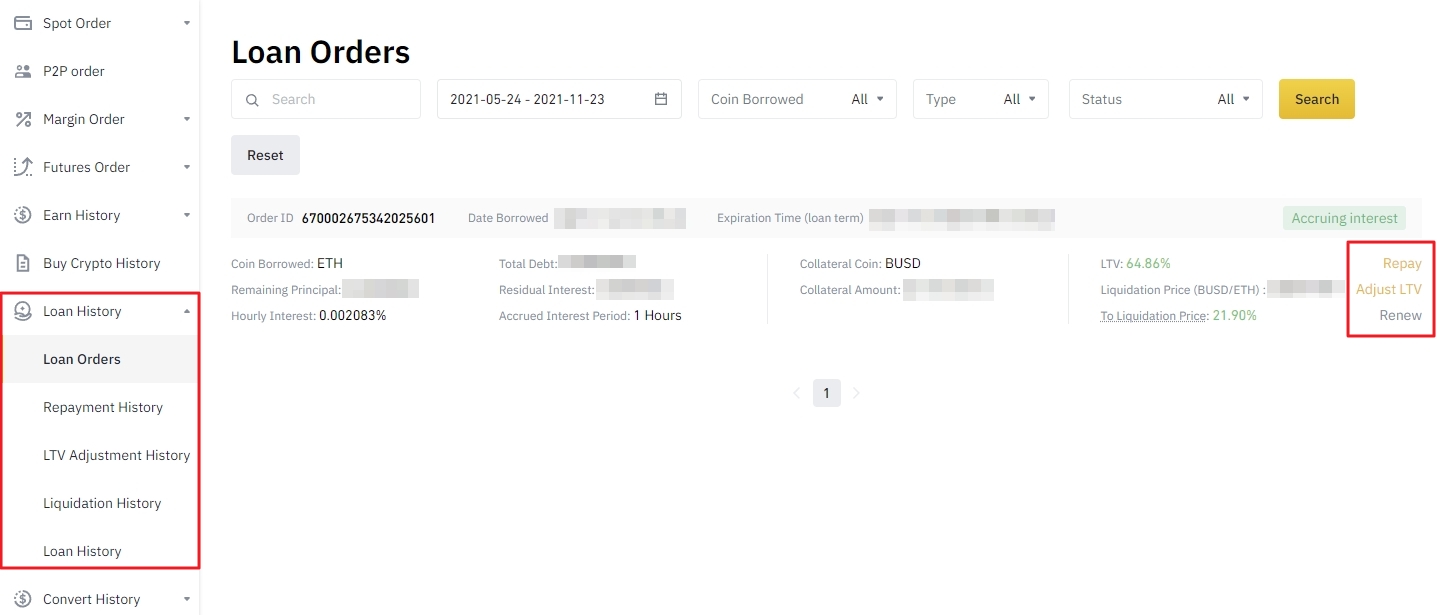

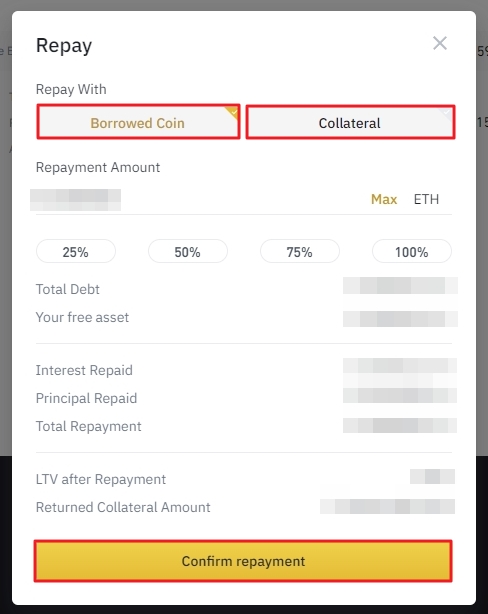

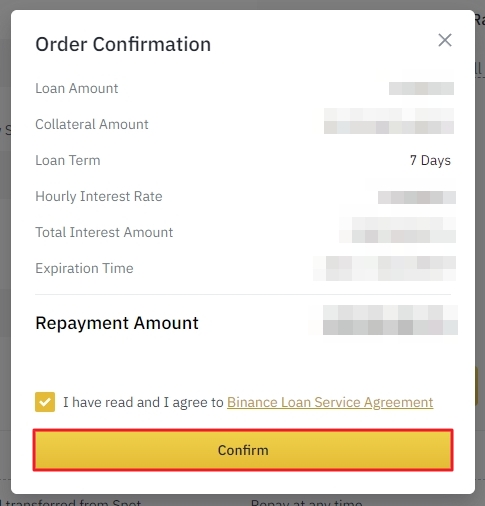

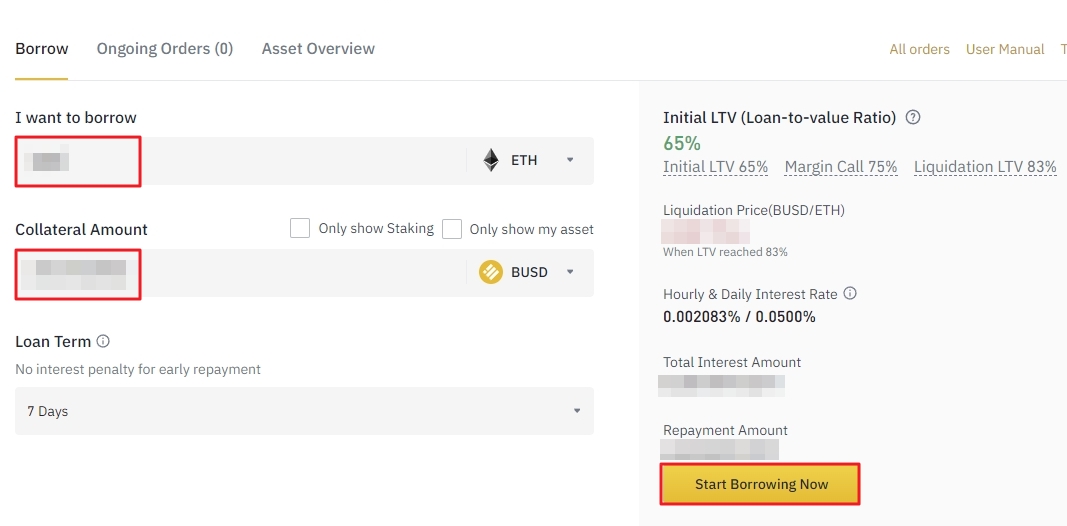

What Are Binance Crypto Loans And How To Use Them Coincheckup Blog Cryptocurrency News Articles Resources

You can borrow as much as 90 percent of your home equity.

. We do not offer additional loans above a maximum LTV of 85 including your existing mortgage. So if you deposit 25 on a home that would mean the LTV is 75. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

To get an idea of what you can expect to make in rental income from a property do some online research or contact a letting agent. If youre looking to maximise how much you can borrow however. Find out how much you could borrow for a mortgage compare rates and calculate monthly costs using our mortgage calculator.

A 100K salary puts you in a good position to buy a home. LTV refers to the loan amount as a percentage of the propertys value. The amount you can borrow with a buy-to-let mortgage depends on how much youre expecting to earn in rental income.

Lets presume you and your spouse have a combined total annual salary of 102200. You can also input your spouses income if you intend to obtain a joint application for the mortgage. Therefore you may find that the amount you can borrow from one lender differs from another based on this calculation.

Since the property. A loan of last resort or a short-term bridge loan. Paying 500 a month over 25.

The price at which the lenders borrow money therefore affects the cost of borrowing. Debt Consolidation Calculator How much can you save by taking out a single loan to cover all your existing credit card debt. You can use the above calculator to estimate how much you can borrow based on your salary.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. Use our mortgage calculator to get an idea of how much you could borrow find a mortgage and compare monthly rates and payments. Home buying with a 70K salary.

We use these numbers to calculate your LTV ratio which then helps us find your home equity and how much money you can borrow. Hard Money Loan. An example of an interest coverage ratio is 145 at a notional interest rate of 55.

If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a. The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. A down payment is a type of payment made in cash during the onset of the purchase of an expensive good or service.

Partners Providing you own 25 share or more of the limited. For example if an individual borrows 800000 to purchase a property valued at 1000000 the LTV is 80. Your loan to value ratio is one of the biggest factors in deciding how much you can borrow and how expensive your mortgage will be.

Youll also need a larger down payment. By taking into account all of those numbers you can easily calculate how much of a mortgage payment you can afford at your current income. LTV is calculated as the ratio between the crypto credit amount in USD and the value of the collateral in USD expressed as a percentage.

Base 119 to 280225. Base 119 to 280225. VA mortgage rates can often be as much as 40 basis points 040 lower than rates for a comparable conventional loan.

In general the higher your LTV the more you can expect to pay in interest costs and closing costs. This is the how long youd like to borrow the money for eg. The payment typically represents only a percentage of the full.

Typically a lender will want to see a rental income thats 20-30 more than your mortgage. Whether youre buying a new home remortgaging to a new deal or buying a Buy to Let use the tools below to see how much you could borrow and the mortgages rates and monthly payments you could potentially apply for. You have 25 percent equity in the home.

Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. Do bear in mind you should plan to pay your mortgage off before you reach your retirement age. Currently offers up to 55 times the income of applicants so long as the LTV is 85 or less and at least one applicant earns more than 75k or joint applicants earn more than 100k between them.

The loan to value ratio or LTV is the size of the loan against the value of the property. Loan-To-Value Ratio - LTV Ratio. In terms of mortgage affordability the VA loan is hard to beat if youre.

Base 119 to 280225. Loan assessments with higher LTV ratios are considered higher risk and may include higher interest rates for the homebuyer. Calculate the difference a consolidation loan can make.

Mortgage Term 25. This is the how long youd like to borrow the money for eg. In the UK and US 25 to 30 years is the usual.

A credit lines loan-to-value LTV ratio determines the amount of crypto collateral you need in order to take out a crypto credit. Hard money loans are backed by the value of the property not by the credit worthiness of the borrower. Lower LTV means that a higher down payment was made and therefore the risk of.

Spring EQs minimum credit score is 680 and its maximum DTI ratio is 50 percent which is a draw for people with tight finances. Do bear in mind you should plan to pay your mortgage off before you reach your retirement age. One of the first questions you ask when you want to buy a home is how much house can I afford.

Or long 50 years plus. The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage. Want to borrow 1000 on a credit card but repay in 6 months - well now you can find the cheapest credit card for that.

95 LTV Mortgages 90 LTV. If your LTV is 80 youll know your lender is willing to lend you a substantial amount of money but youll need to cover the remaining 20 out of pocket. With a 100000 salary you have a shot at.

The loan-to-value LTV limit determines the maximum amount an individual can borrow from a financial institution FI for a housing loan.

What Are Binance Crypto Loans And How To Use Them Coincheckup Blog Cryptocurrency News Articles Resources

What Are Binance Crypto Loans And How To Use Them Coincheckup Blog Cryptocurrency News Articles Resources

What Are Binance Crypto Loans And How To Use Them Coincheckup Blog Cryptocurrency News Articles Resources

تويتر Celsius على تويتر Jarronjackson4 Coindesk Coinbase Nate Dicamillo Welcome To Celsius Be Sure To Join Using A Referral Code And You Can Get 20 In Btc When You Transfer 200 Or

Coinloan Review 2022 Features Crypto Loans Fees

Coinloan Srypto Fiat Loans Apps On Google Play

How To Reduce My Loan Burden Quora

12 Best Crypto Lending Platforms In 2022

What Are Binance Crypto Loans And How To Use Them Coincheckup Blog Cryptocurrency News Articles Resources

Current Report 8 K

12 Best Crypto Lending Platforms In 2022

12 Best Crypto Lending Platforms In 2022

What Is Celsius Use Crypto To Earn Rewards And Borrow Cash Baselynk

12 Best Crypto Lending Platforms In 2022

What Are Binance Crypto Loans And How To Use Them Coincheckup Blog Cryptocurrency News Articles Resources

12 Best Crypto Lending Platforms In 2022

12 Best Crypto Lending Platforms In 2022